ANNEX IV

Methods for calculating embedded emissions for the purpose of Article 7

1. DEFINITIONS

For the purposes of this Annex and of Annexes V and VI, the following definitions apply:

(a) |

‘simple goods’ means goods produced in a production process requiring exclusively input materials (precursors) and fuels having zero embedded emissions; |

(b) |

‘complex goods’ means goods other than simple goods; |

(c) |

‘specific embedded emissions’ means the embedded emissions of one tonne of goods, expressed as tonnes of CO2e emissions per tonne of goods; |

(d) |

‘CO2 emission factor’, means the weighted average of the CO2 intensity of electricity produced from fossil fuels within a geographic area; the CO2 emission factor is the result of the division of the CO2 emission data of the electricity sector by the gross electricity generation based on fossil fuels in the relevant geographic area; it is expressed in tonnes of CO2 per megawatt-hour; |

(e) |

‘emission factor for electricity’ means the default value, expressed in CO2e, representing the emission intensity of electricity consumed in production of goods; |

(f) |

‘power purchase agreement’ means a contract under which a person agrees to purchase electricity directly from an electricity producer; |

(g) |

‘transmission system operator’ means an operator as defined in Article 2, point (35), of Directive (EU) 2019/944 of the European Parliament and of the Council (1). |

2. DETERMINATION OF ACTUAL SPECIFIC EMBEDDED EMISSIONS FOR SIMPLE GOODS

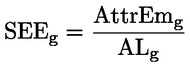

For determining the specific actual embedded emissions of simple goods produced in a given installation, direct and, where applicable, indirect emissions shall be accounted for. For that purpose, the following equation is to be applied:

Where:

SEEg |

are the specific embedded emissions of goods g, in terms of CO2e per tonne;產品的特定碳排放( CO2e公噸) |

AttrEmg碳排放 |

are the attributed emissions of goods g, and產品分配之碳排放 |

ALg生產之貨物總數 |

is the activity level of the goods, being the quantity of the goods produced in the reporting period in that installation.報告期間生產之貨物總數 |

‘Attributed emissions’ mean the part of the installation’s emissions during the reporting period that are caused by the production process resulting in goods g when applying the system boundaries of the production process defined by the implementing acts adopted pursuant to Article 7(7). The attributed emissions shall be calculated using the following equation:

Where:

DirEm直接排放 |

are the direct emissions, resulting from the production process, expressed in tonnes of CO2e, within the system boundaries referred to in the implementing act adopted pursuant to Article 7(7), and |

IndirEm間接排放 |

are the indirect emissions resulting from the production of electricity consumed in the production processes of goods, expressed in tonnes of CO2e, within the system boundaries referred to in the implementing act adopted pursuant to Article 7(7). |

3. DETERMINATION OF ACTUAL EMBEDDED EMISSIONS FOR COMPLEX GOODS

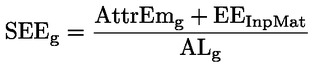

For determining the specific actual embedded emissions of complex goods produced in a given installation, the following equation is to be applied:

Where:

AttrEmg |

are the attributed emissions of goods g; |

ALg |

is the activity level of the goods, being the quantity of goods produced in the reporting period in that installation, and |

EEInpMat |

are the embedded emissions of the input materials (precursors) consumed in the production process. Only input materials (precursors) listed as relevant to the system boundaries of the production process as specified in the implementing act adopted pursuant to Article 7(7) are to be considered. The relevant EEInpMat are calculated as follows: |

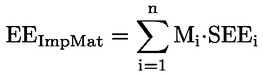

Where:

Mi |

is the mass of input material (precursor) i used in the production process, and |

SEEi |

are the specific embedded emissions for the input material (precursor) i. For SEEi the operator of the installation shall use the value of emissions resulting from the installation where the input material (precursor) was produced, provided that that installation’s data can be adequately measured. |

4. DETERMINATION OF DEFAULT VALUES REFERRED TO IN ARTICLE 7(2) AND (3)

For the purpose of determining default values, only actual values shall be used for the determination of embedded emissions. In the absence of actual data, literature values may be used. The Commission shall publish guidance for the approach taken to correct for waste gases or greenhouse gases used as process input, before collecting the data required to determine the relevant default values for each type of goods listed in Annex I. Default values shall be determined based on the best available data. Best available data shall be based on reliable and publicly available information. Default values shall be revised periodically through the implementing acts adopted pursuant to Article 7(7) based on the most up-to-date and reliable information, including on the basis of information provided by a third country or group of third countries.

4.1. Default values referred to in Article 7(2)

When actual emissions cannot be adequately determined by the authorised CBAM declarant, default values shall be used. Those values shall be set at the average emission intensity of each exporting country and for each of the goods listed in Annex I other than electricity, increased by a proportionately designed mark-up. This mark-up shall be determined in the implementing acts adopted pursuant to Article 7(7) and shall be set at an appropriate level to ensure the environmental integrity of the CBAM, building on the most up-to-date and reliable information, including on the basis of information gathered during the transitional period. When reliable data for the exporting country cannot be applied for a type of goods, the default values shall be based on the average emission intensity of the X % worst performing EU ETS installations for that type of goods. The value of X shall be determined in the implementing acts adopted pursuant to Article 7(7) and shall be set at an appropriate level to ensure the environmental integrity of the CBAM, building on the most up-to-date and reliable information, including on the basis of information gathered during the transitional period.

4.2. Default values for imported electricity referred to in Article 7(3)

Default values for imported electricity shall be determined for a third country, group of third countries or region within a third country based on either specific default values, in accordance with point 4.2.1, or, if those values are not available, on alternative default values, in accordance with point 4.2.2.

Where the electricity is produced in a third country, group of third countries or region within a third country, and transits through third countries, groups of third countries, regions within a third country or Member States with the purpose of being imported into the Union, the default values to be used are those from the third country, group of third countries or region within a third country where the electricity was produced.

4.2.1. Specific default values for a third country, group of third countries or region within a third country

Specific default values shall be set at the CO2 emission factor in the third country, group of third countries or region within a third country, based on the best data available to the Commission.

4.2.2. Alternative default values

Where a specific default value is not available for a third country, a group of third countries, or a region within a third country, the alternative default value for electricity shall be set at the CO2 emission factor in the Union.

Where it can be demonstrated, on the basis of reliable data, that the CO2 emission factor in a third country, a group of third countries or a region within a third country is lower than the specific default value determined by the Commission or lower than the CO2 emission factor in the Union, an alternative default value based on that CO2 emission factor may be used for that third country, group of third countries or region within a third country.

4.3 Default values for embedded indirect emissions

Default values for the indirect emissions embedded in a good produced in a third country shall be determined on a default value calculated on the average, of either the emission factor of the Union electricity grid, the emission factor of the country of origin electricity grid or the CO2 emission factor of price-setting sources in the country of origin, of the electricity used for the production of that good.

Where a third country, or a group of third countries, demonstrates to the Commission, on the basis of reliable data, that the average electricity mix emission factor or CO2 emission factor of price-setting sources in the third country or group of third countries is lower than the default value for indirect emissions, an alternative default value based on that average CO2 emission factor shall be established for this country or group of countries.

The Commission shall adopt, no later than 30 June 2025, an implementing act pursuant to Article 7(7) to further specify which of the calculation methods determined in accordance with the first subparagraph shall apply to the calculation of default values. For that purpose, the Commission shall base itself on the most up-to-date and reliable data, including on data gathered during the transitional period, as regards the quantity of electricity used for the production of the goods listed in Annex I, as well as the country of origin, generation source and emission factors related to that electricity. The specific calculation method shall be determined on the basis of the most appropriate way to achieve both of the following criteria:

— |

the prevention of carbon leakage; |

— |

ensuring the environmental integrity of the CBAM. |

5. CONDITIONS FOR APPLYING ACTUAL EMBEDDED EMISSIONS IN IMPORTED ELECTRICITY

An authorised CBAM declarant may apply actual embedded emissions instead of default values for the calculation referred to in Article 7(3) if the following cumulative criteria are met:

(a) |

the amount of electricity for which the use of actual embedded emissions is claimed is covered by a power purchase agreement between the authorised CBAM declarant and a producer of electricity located in a third country; |

(b) |

the installation producing electricity is either directly connected to the Union transmission system or it can be demonstrated that at the time of export there was no physical network congestion at any point in the network between the installation and the Union transmission system; |

(c) |

the installation producing electricity does not emit more than 550 grammes of CO2 of fossil fuel origin per kilowatt-hour of electricity; |

(d) |

the amount of electricity for which the use of actual embedded emissions is claimed has been firmly nominated to the allocated interconnection capacity by all responsible transmission system operators in the country of origin, the country of destination and, if relevant, each country of transit, and the nominated capacity and the production of electricity by the installation refer to the same period of time, which shall not be longer than one hour; |

(e) |

the fulfilment of the above criteria is certified by an accredited verifier, who shall receive at least monthly interim reports demonstrating how those criteria are fulfilled. |

The accumulated amount of electricity under the power purchase agreement and its corresponding actual embedded emissions shall be excluded from the calculation of the country emission factor or the CO2 emission factor used for the purpose of the calculation of indirect electricity embedded emissions in goods in accordance with point 4.3, respectively.

6. CONDITIONS TO APPLYING ACTUAL EMBEDDED EMISSIONS FOR INDIRECT EMISSIONS

An authorised CBAM declarant may apply actual embedded emissions instead of default values for the calculation referred to in Article 7(4) if it can demonstrate a direct technical link between the installation in which the imported good is produced and the electricity generation source or if the operator of that installation has concluded a power purchase agreement with a producer of electricity located in a third country for an amount of electricity that is equivalent to the amount for which the use of a specific value is claimed.

7. ADAPTATION OF DEFAULT VALUES REFERRED TO IN ARTICLE 7(2) BASED ON REGION-SPECIFIC FEATURES

Default values can be adapted to particular areas and regions within third countries where specific characteristics prevail in terms of objective emission factors. When data adapted to those specific local characteristics are available and more targeted default values can be determined, the latter may be used.

Where declarants for goods originating in a third country, a group of third countries or a region within a third country can demonstrate, on the basis of reliable data, that alternative region-specific adaptations of default values are lower than the default values determined by the Commission, such region-specific adaptations can be used.

(1) Directive (EU) 2019/944 of the European Parliament and of the Council of 5 June 2019 on common rules for the internal market for electricity and amending Directive 2012/27/EU (OJ L 158, 14.6.2019, p. 125).